Contents:

To do that, traders look at different currency pairs and follow the same trend trading strategy. If the lime colored line of the 1SSRC custom indicator breaks below the 0.00 level, it is an indication of a trend reversal i.e. an exit or take profit is advised. Since this technique uses average price data, it does not show the exact close and open prices. As a result, this might not work for traders with many active securities, for example, day traders. This Japanese technique tries to filter out the market noise, enabling one to predict price movements better and identify trends.

You should consider whether you can afford to take the risk of losing your money. If the candle sequence flips from one colour to another, there is a strong chance of a trend reversal. That is exactly the purpose of a recorded video course, that you can watch the content as often as you want. This is the case with the Scalping is fun course, especially with the recordings of the live trades.

Recommended Articles

Or, if it does that, the rules of a bearish trend aren’t in place anymore. Hence, the trend trading Forex scalping strategy ends with the first trade that gets to be stopped. The main Japanese contribution to technical analysis came with the introduction of the candlesticks chart.

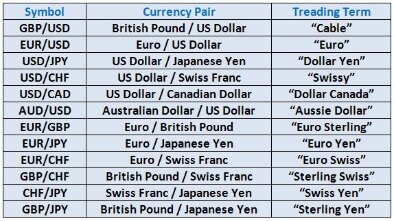

These changes in momentum, of course, also mark the start of a new trend and can be easily identified in the GBPUSD’ Cable’ market on an hourly time frame. The formula behind the candlesticks makes trend direction and reversal easier to spot, and as there are fewer of them, they tend to be more reliable. If the lime colored line of the 1SSRC.ex4 custom indicator breaks above the 0.00 level, it is an indication of a price reversal i.e. an exit or take profit is advised. When traders spot this pattern, they might consider adding to their short position while exiting the long ones.

The argument for that comes from the price that had the power of breaking the lower lows series. The strategies explained here belong to Forex scalping and work on all the timeframes mentioned above. Note, though, that the hourly chart is there only to show the maximum timeframe for this trading style. Instead, the focus sits with the lower timeframes. The closing of the candle Heiken Ashi is very close to the 200 ema resulting in a false signal.

The Heiken Ashi Zone Trade forex strategy is a strategy that uses a new version of the Heiken Ashi indicator. FREE EXCEL RESOURCESLearn MS Excel right from scratch. Master excel formulas, graphs, shortcuts with 3+hrs of Video. This is difficult in today’s Forex market due to the nature of it. Nowadays the Forex brokers use five-digit quotations for most of the pairs part of the Forex dashboard.

At the end of it, you’ll find out that Heikin Ashi candles come to complete the Japanese approach to technical analysis. Above all, this article aims at providing an understanding of both Heikin Ashi candles and Forex scalping. The Forex scalping strategies presented here blend the two concepts to give powerful trading setups. Renko charts are not based on time, only price movement, although time is still placed on the x-axis of the chart.

Get your Super Smoother Indicator! Enter your email address below:

Being quickly followed by a green candle confirms that the time has come to close out short positions and look to go long. The two charts have obvious similarities, they are, after all, based on the same raw data, but the Heiken Ashi candles have applied a formula that creates subtle differences. As a result, the shape of the Heiken Ashi candles offers different insights into market momentum.

With everything described above in mind, here’s the first entry using the Heikin Ahi chart as a trend indicator. When the first candle after the series of lower highs turned to read, or bearish, traders enter on the short side. As it turned out, the Japanese traders used candlesticks patterns to forecast rice futures in the 1700’s, way before the stock market concept in the United States was even born. A short entry is taken when the price breaks below the head and shoulders reversal pattern. The trade is exited when the price crosses above the 50-period SMA or when the price reaches the profit target for a head and shoulders pattern. The estimated target for a head and shoulders is the height of the pattern (approximately 1.37 — 1.35) subtracted from the breakout point (near 1.35) for a target near 1.33.

Digital Currency Group CEO: Bitcoin Has “Hit The Bottom for The Year” – Ethereum World News – Ethereum World News

Digital Currency Group CEO: Bitcoin Has “Hit The Bottom for The Year” – Ethereum World News.

Posted: Thu, 19 Jul 2018 07:00:00 GMT [source]

To make the most of heikin ashi candlesticks, you should adjust your stop loss strategies according to the market conditions and your trading style. Additionally, a trailing stop loss is a dynamic stop loss that moves with the price action, allowing you to lock in profits and minimize losses. Alternatively, you can use a fixed percentage or dollar amount of your account balance or trade size to control your risk exposure. All of these strategies can help you adjust your stop loss with heikin ashi candlesticks. Heikin ashi candlesticks are a popular tool for technical analysis, especially for identifying trends and reversals. However, they also have some drawbacks and limitations that you need to be aware of when using them for risk management and stop loss strategies.

How do you use moving averages to set stop loss levels for swing trading?

Lastly, keeping a trading journal can help you review your trades and analyze your performance, emotions, and lessons learned. This way, you can track how well you followed your trading plan and how you managed your risk and emotions. Heikin ashi candlesticks are a modified version of the traditional Japanese candlesticks, which use four price points to represent the price action of a given period. Heikin ashi candlesticks, on the other hand, use a different formula to calculate the open and close prices, based on the average of the previous and current periods. This creates a smoother and more consistent appearance of the candles, which makes it easier to spot trends and reversals. Heikin Ashi is useful for short-term trading strategies, whether day trading or swing trading.

- Hence, for a candle to get the exact closing price like the opening one is unlikely.

- Let’s look at another example, this time using an hourly chart of a stock index.

- Position sizing is key, and you can use a calculator or formula to determine the optimal number of shares or contracts to trade.

- When the Western technical analysis world met the Japanese approach, it was stunned to find out the simplicity and the power of the Japanese candlesticks.

One of the easiest ways to use Heikin Ashi candles is to take advantage of the chart’s uniformity. A quick comparison between the two charts won’t tell much. what is the difference between erp crm and scm A proper understanding of a Heikin Ashi candles chart starts with comparing the two. Moreover, the comparison must consider the same currency pair and chart.

All classic technical analysis patterns are easy to spot on an Heikin Ashi chart. Because the way the Heikin Ashi candles appear on the chart, classic Japanese reversal patterns won’t work. We listed the most relevant ones at the start of this article. As the name of this paragraph suggests, the entry on the short side is when the Heikin Ashi candles change from blue to red.

Heikin Ashi calculation

Let us look at a few primary signals that help individuals spot buying opportunities and trends. Forex scalping with Heikin Ashi candles provides an excellent opportunity to profit from the market swings. By using lower timeframes, traders take advantage of all market https://day-trading.info/ moves. That said, I thought it would be fun to come up with a very simple 1m scalping system. This indicates that the trend may not be as long-lasting, and sure enough, there is soon a period of sideways trading denoted by a mixture of red and green candles.

How to trade using the Heikin Ashi candlestick – IG

How to trade using the Heikin Ashi candlestick.

Posted: Fri, 18 Dec 2020 12:39:07 GMT [source]

An online course is a way to learn a new skill or acquire new knowledge from the comfort of your own home via the Internet. So you don’t have to be online at a specific time, as you do with a webinar, for example. You can watch the videos at your own pace when you want and as often as you want. Once you have purchased the course, the content is available to you immediately and indefinitely. The Acceleration/Deceleration Oscillator and Awesome Oscillator is integrated into it to be able to spot favorable trading zones.

Forex scalping is the preferred way the retail traders use to approach the market. Leaving the HFT (High-Frequency Trading) industry aside, Forex scalping is mostly done by retail traders. When the Western technical analysis world met the Japanese approach, it was stunned to find out the simplicity and the power of the Japanese candlesticks.

The indicator provides a clear picture of the overall market activity and traders use it more in trend trading strategies than in reversal ones. A Heikin Ashi chart takes an average of prices to create candles. Renko charts also smooth out price movements, but they use a different formula and have a different look.

Heiken Ashi reversal patterns

All candles open from the middle of the previous one. The closing price of each candle is the average value of the OHLC prices combined. The numbers in a classic candlestick chart are presented as Open, High, Low, Close , but in a Heiken Ashi, they are presented as Close, Open, High, Low . This method filters out the market noise and minimizes small corrections, thus making the signs more transparent. Any information or advice contained on this website is general in nature only and does not constitute personal or investment advice. You should seek independent financial advice prior to acquiring a financial product.

Since HA charts are based on average price movements, it also makes them hard to use for setting stop-loss levels. In the strategy examples, a trailing stop-loss was used with the moving average, or a change in colour on the HA chart. These can work but the risk is unknown at the start of the trade. To control the risk with a fixed stop-loss level, referring to a normal candlestick chart is required. This way, the stop-loss can be set based on the price levels and patterns the price actually made, not an HA average, which distorts where the price has actually been. With the introductionof Heikin Ashi candles on the IG trading platform, IG Group is continuing to improve the charting capabilities of the platform.

Whether your trading style is based on day trading, swing trading or trend following, incorporating signalsfrom the below is always a good idea. The majority of the trading platforms offer this chart. Traders can select it to take their buy-and-sell decisions.

The green doji candle at Reversal Candle 3 is the clue that it might be time to exit long positions and look to go short again. The downward trend which follows is marked by a long sequence of red candles and a chance to profit from positions that are short GBPUSD. If traders spot it, they might consider exiting short positions while adding to their long positions. To scalp on the signals, traders wait for the price to reverse beyond the highest or the lowest Doji candle’s value . Finally, they set the take profit at a distance equal to three times the risk . We explained earlier that Forex scalping means taking multiple positions during the course of the trading day.

This is a new type of article that we started with the help of AI, and experts are taking it forward by sharing their thoughts directly into each section. Experts are adding insights into this AI-powered collaborative article, and you could too. This button displays the currently selected search type. When expanded it provides a list of search options that will switch the search inputs to match the current selection.