Contents:

This assumption most closely resembles an actual flow of products earning it the distinction as the most correct valuing method in theory. Consider your local supermarket — the first gallons of milk the store purchased to sell to customers are the first gallons sold usually. Otherwise, a lot of milk would spoil, thus creating a loss for the store. A program like this makes it a lot easier to check your records on your laptop or smartphone even when you’re out of the office.

Silicon Valley Bank’s Failure Sparks Speculation that FASB … – Thomson Reuters Tax & Accounting

Silicon Valley Bank’s Failure Sparks Speculation that FASB ….

Posted: Wed, 15 Mar 2023 07:00:00 GMT [source]

If you’re interested in working remotely as a bookkeeper, applying directly or joining the Intuit Tax and Bookkeeping Talent Community may be the right move. You can work with other bookkeepers and tax experts to share and expand your knowledge. What’s it like to work as a Front Office Expert or Back Office Expert for QuickBooks Live? Watch the videos to find out what a day in the life is like for our Intuit bookkeeping experts. If you’re interested in being a freelance virtual bookkeeper, you can sign up for freelance marketplace websites to connect with potential clients.

A Beginner’s Guide to Bookkeeping

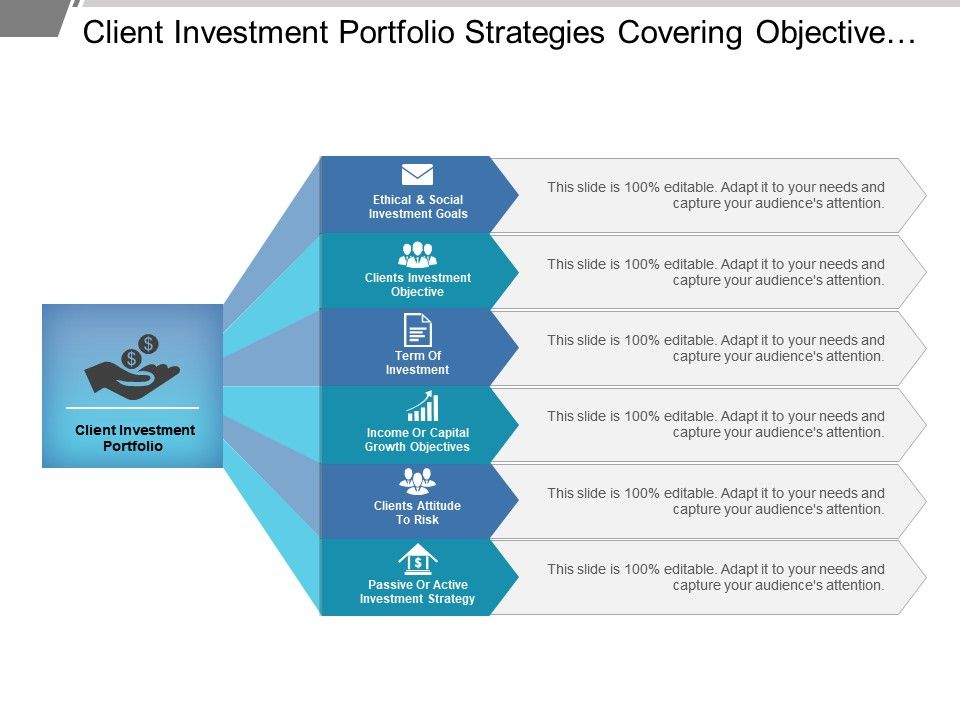

In 2012, she started Pocket Protector Bookkeeping, a virtual bookkeeping and managerial accounting service for small businesses. One of the main reasons for bookkeeping is maintaining all financial records of a business that shows the financial position of every head or account of income and expenditure. The companies can obtain detailed information about each income or expense instantaneously through bookkeeping. Therefore, those who do not like math, get confused easily when making simple calculations, or are generally opposed to number crunching should not apply. Bookkeeping Basics — Define accounting, understand bookkeeping tasks, gain foundational knowledge of double-entry bookkeeping, and learn about ethical and social responsibility.

- However, without business confidence, your potential and value is likely to go unseen.

- In this guide, The Ascent breaks down the basics to help you get a firm grip on those terms.

- Accrual AccountingAccrual Accounting is an accounting method that instantly records revenues & expenditures after a transaction occurs, irrespective of when the payment is received or made.

- A certified public accountant is a designation given to those who meet education and experience requirements and pass an exam.

In this day and age, the providers you contract with don’t need to be in the same city, state or even time zone as you. Remote work has expanded across nearly every field, including bookkeeping. If you find someone who is a good fit for your business needs, it doesn’t matter if they are in California while you work from New York.

This book is written with the average reader in mind, and the author has taken a detailed approach to explain each concept. Let us discuss each bookkeeping book in detail, along with its key takeaways and reviews. It’s important to keep payroll expenses accurate and updated to ensure the business meets legal requirements.

Learn Something New

Although accrual basis statements are more accurate, many business owners find cash basis reports easier to understand. Each entry into your bookkeeping system impacts at least two accounts in your business’s chart of accounts. Proper data entry — or data management if you rely on automation for your data entry — ensures that transactions are being posted to the correct accounts. Accurate classification of transactions enables you to produce financial management reports which can be used to make strategic business decisions. Accountants, on the other hand, use the information provided by bookkeepers to summarize a business’s financial position and render financial advice to the business owner.

A beginner’s guide to accounting fraud (and how to get away with it) – Financial Times

A beginner’s guide to accounting fraud (and how to get away with it).

Posted: Fri, 14 Apr 2023 05:00:32 GMT [source]

Even if you are using an online system for bookkeeping, delegating an employee with keeping track of it on a daily basis is very important. One of the downfalls of some bookkeeping software is that the artificial intelligence behind the software can make mistakes a human wouldn’t make while entering the data. The most common of these mistakes is assigning the wrong payee name to a transaction. You must make sure your transactions are being identified correctly.

What Is the Importance of Bookkeeping?

Ideally, you want to make sure your data entry comes not from the bank feed, but from source documents like receipts or bills. This ensures that only valid business transactions are being entered into your books. Today’s bookkeeping software allows you to snap a photo of or scan in your source documents, and then OCR technology will extract the pertinent information and do much of the data entry for you.

As per the readers, this book is also not for advanced bookkeepers. It’s for those who have knowledge in bookkeeping and who are at a beginner or intermediate level. However, this book does a good job and provides many forms, schedules, and a brief overview of every topic.

The two careers are similar, and accountants and bookkeepers often work side by side. However, significant differences exist, like work conducted in each career and needed to be successful. The following analysis compares the education requirements, skills required, typical starting salaries, and job outlooks for accounting and bookkeepers.

Bookkeeping involves the recording, on a regular basis, of a company’s financial transactions. With proper bookkeeping, companies are able to track all information on its books to make key operating, investing, and financing decisions. Very small businesses may choose a simple bookkeeping system that records each financial transaction in much the same manner as a checkbook. Businesses that have more complex financial transactions usually choose to use the double-entry accounting process.

But First, What is Bookkeeping?

As your business grows and you begin making higher profits, hiring staff and handling more transactions, however, it may make sense to outsource the details of bookkeeping to someone else. QuickBooks Live bookkeeper can help ensure that your business’s books close every month, and you’re primed for tax season. Our expert CPAs and QuickBooks ProAdvisors average 15 years of experience working with small businesses across various industries.

https://1investing.in/, up-to-date bookkeeping is the backbone of any successful small business. No matter what type of business you operate, an understanding of bookkeeping best practices is essential for keeping your business running smoothly, now and in the future. It provides the data that investors look for ― Investors want to know how a business is faring to determine their investment’s value.

The history of bookkeeping, in fact, closely reflects the history of commerce, industry, and government and, in part, helped to shape it. As a bookkeeper, your attention to detail must be almost preternatural. Careless mistakes that seem inconsequential at the time can lead to bigger, costlier, more time-consuming problems down the road. Rarely does a bookkeeper work on one big project for an eight-hour shift; instead, a typical workday involves juggling five or six smaller jobs.

So, which of these methods should you use in your bookkeeping to get the best, most accurate picture of your spending habits? You’re also responsible for communicating with your employees and allowing them to know the financial state of your firm. They need to know if the company is making some progress and how they contribute to its growth. Bookkeeping accounting ensures that you have the right information to talk to your team and make them feel like they’re part of the company. Financial informationfor the end of the fiscal period at the last-minute. With proper bookkeeping, you can determine the types of taxes and calculate the amount payable in advance.

outstanding checks And Cash EquivalentCash and Cash Equivalents are assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation. Cash and paper money, US Treasury bills, undeposited receipts, and Money Market funds are its examples. They are normally found as a line item on the top of the balance sheet asset.